Well, it’s not lying, but it is misleading. Last week, we dove into where the political ad dollars are going in 2026 with our Video Ad Spend Projections. This week we’ll get into where time is spent on the TV screen.

If you’re also a nerd and read AdTech posts on LinkedIn, you’ll find there’s no topic talked and argued about more than Nielsen’s Monthly Gauge Report.

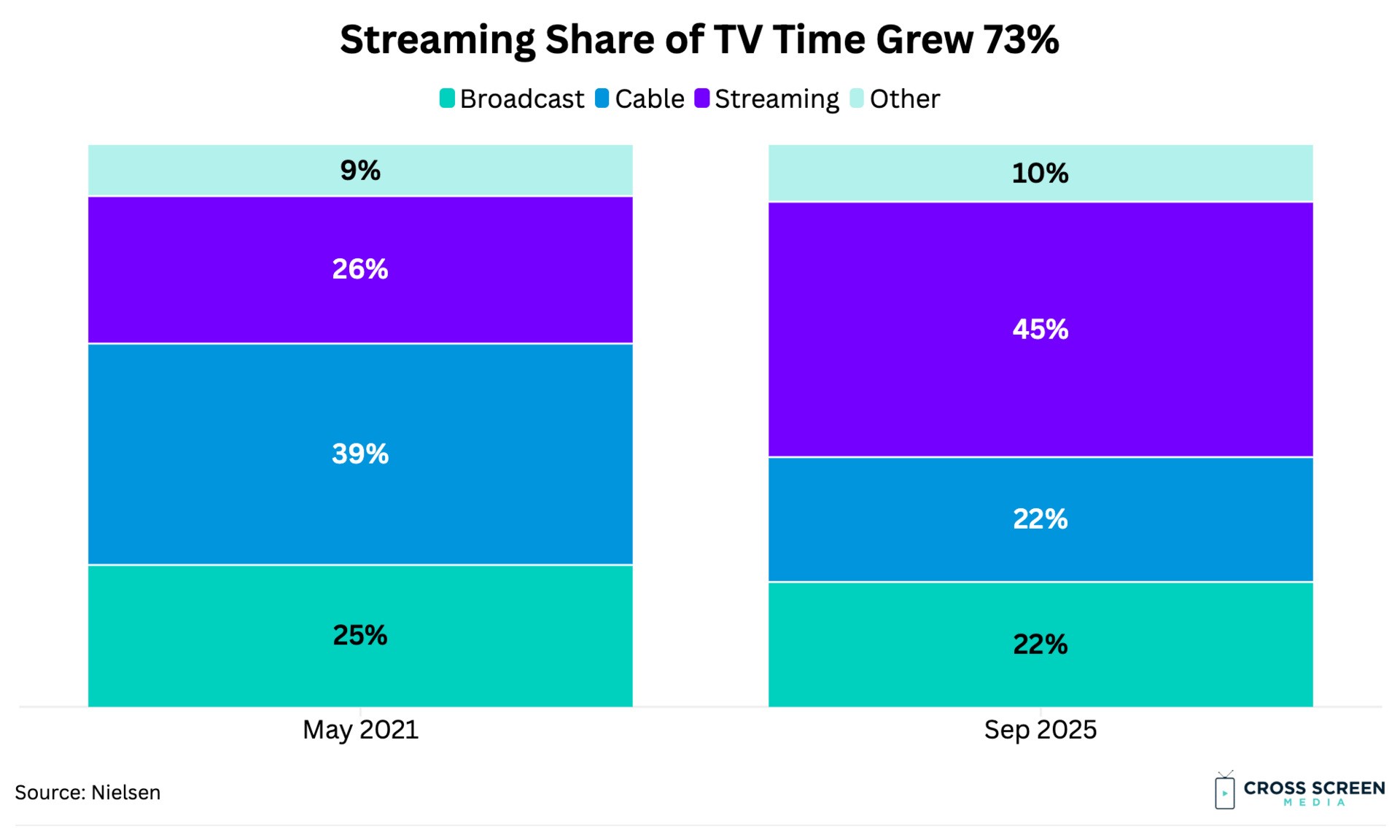

In May 2021, Nielsen, the legacy TV ratings/viewership company, began publishing a monthly report on how people spend time watching TV screens. The change in viewing habits over that time is stark.

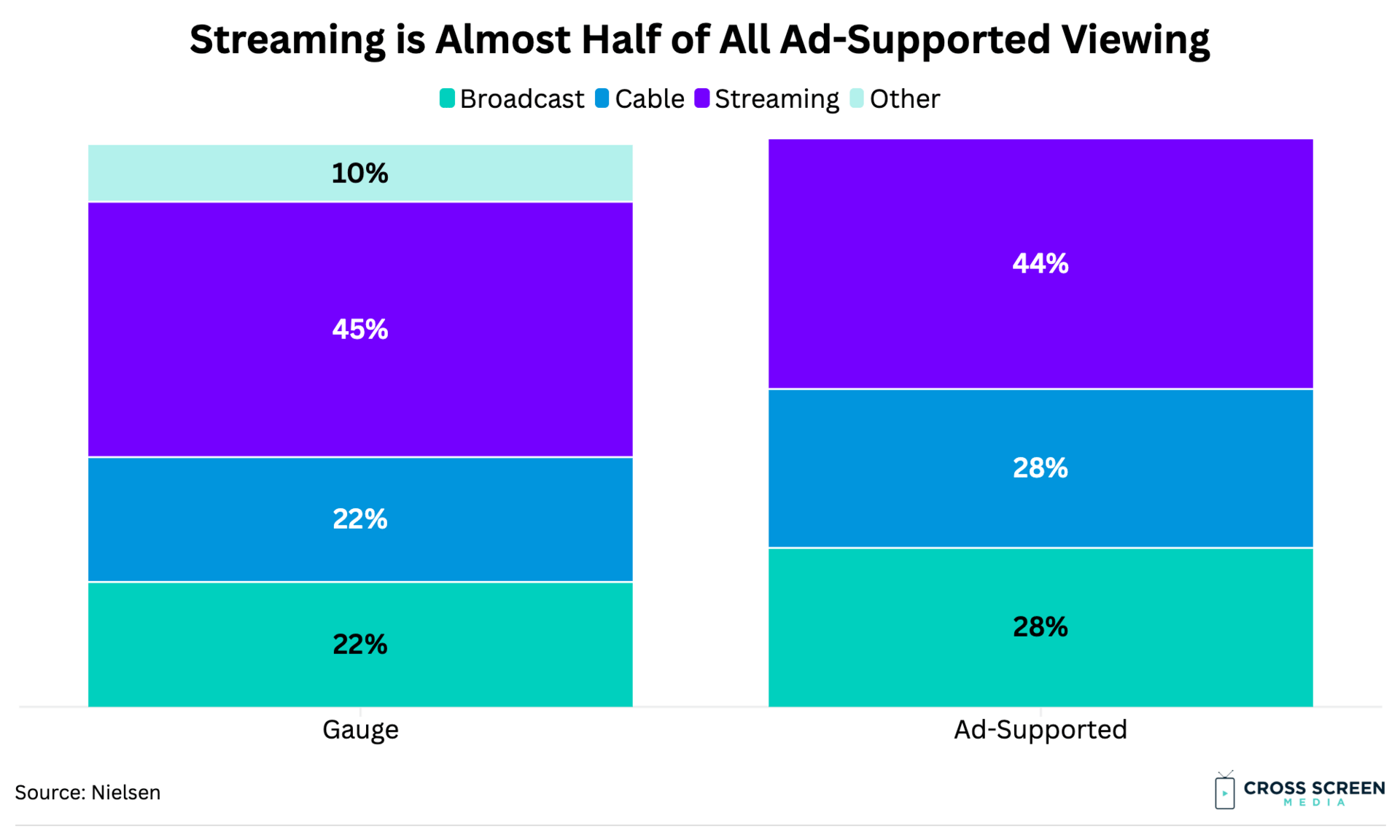

How does the split change when only looking at ad-supported content?

It is tempting to use this clean, well-organized data to impact ad strategies. BUT, it doesn’t tell the whole story. A couple of issues:

What the hell is “Other”? - Video games, audio streaming, and everything Nielsen can’t categorize.

A bunch of video content doesn’t have ads - nice for consumers, not nice for advertisers.

Let’s assume that “Other” is mostly not video and remove it.

The harder part is figuring out what percentage of the remaining inventory is ad-supported vs. not. Huge thank you to eMarketer for their research.

Let’s break that down by medium:

Medium | Ad-Supported | Not Ad-Supported |

|---|---|---|

Broadcast | 90% | 10% |

Cable | 90% | 10% |

Streaming | 69% | 31% |

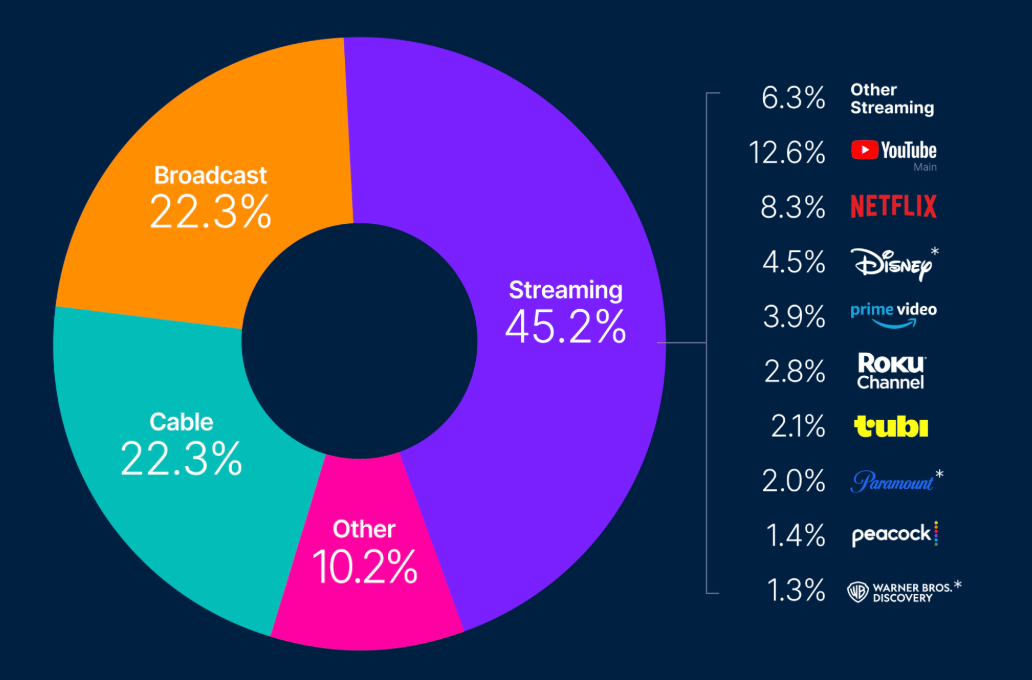

Using viewers of each type as a proxy, here’s the breakdown of Streaming by app:

App | Ad-Supported | Not Ad-Supported |

|---|---|---|

Other Streaming, YouTube | 80% | 20% |

Tubi, Roku Channel | 100% | 0% |

Netflix | 24% | 76% |

Prime | 80% | 20% |

Paramount | 74% | 26% |

Peacock | 79% | 21% |

Disney (inc. Hulu and ESPN+) | 68% | 32% |

Warner Brothers | 31% | 69% |

Total Streaming | 69% | 31% |

Here’s where we stand:

What restrictions do political advertisers face?

This is a huge question.

The Gauge is incredibly misleading for political advertisers.

Here’s why:

By law, TV stations are required to accept political ads. That is not the case for streaming.

Some streaming apps have banned political ads - Netflix and Amazon Prime being the largest.

Some streaming apps have banned audience targeting for political or set aside limited inventory for targeting (more on this in a later edition).

84% of ad-supported streaming allows political ads, but that has a huge impact on our Gauge data. Here’s how time spent on streaming apps changes when we factor in ad-supported content and political restrictions.

App | Nielsen Gauge | Political and Ad Supported |

|---|---|---|

YouTube | 28% | 39% |

Netflix | 18% | 0% |

Disney (inc. Hulu, ESPN) | 10% | 12% |

Prime | 9% | 0% |

Roku Channel | 6% | 11% |

Tubi | 5% | 8% |

Paramount | 4% | 6% |

Warner Brothers | 3% | 2% |

Peacock | 3% | 4% |

Other Streaming | 14% | 19% |

50% —> 39% - The “Political Ad-Supported Gauge” looks pretty different. Streaming drops by 11% and Linear TV jumps back up to 60% of time spent.

What does this mean for political advertisers?

Political is a niche market - Campaigns don’t operate under the same rules as consumer brands. Some platforms ban political ads altogether, others restrict targeting or limit inventory. Staying current on these shifts is vital.

Follow the viewership - Every seller will push you toward what they can sell. Don’t confuse their incentives with your goals. Start with where voters actually watch video, then buy against that.

Use measurement - Work with buyers who provide cross-screen measurement reports. Optimize budgets for real-world reach.

Next week we’ll dive into how different people consume video. There is no “average” voter.

Thank you,

Chauncey